How to Easily Submit the TZ2 Form for Private Renters in Croatia: A Step-by-Step Guide

Submitting the TZ2 form has never been easier for private renters in Croatia, thanks to the online e-Tax system. In this guide, we will walk you through the process of correctly filling out and submitting the form step by step.

Logging Into the e-Tax System

To begin, you will need to log into the e-Tax system through the following link: https://e-porezna.porezna-uprava.hr/Prijava.aspx?ReturnUrl=%2f.

You can log in in two ways:

-

Using an e-ID (with a smart card reader).

-

Using the m-banking mobile application (most banks in Croatia offer this option).

After a successful login, you will be directed to the e-Tax portal.

Finding the TZ2 Form

In the e-Tax system's search bar, type "TZ2". Click on the result that will take you to the TZ2 form. The form will open, ready for you to fill out.

Filling Out the TZ2 Form

Choosing Your Municipality

At the beginning of the form, select the municipality where your property is located.

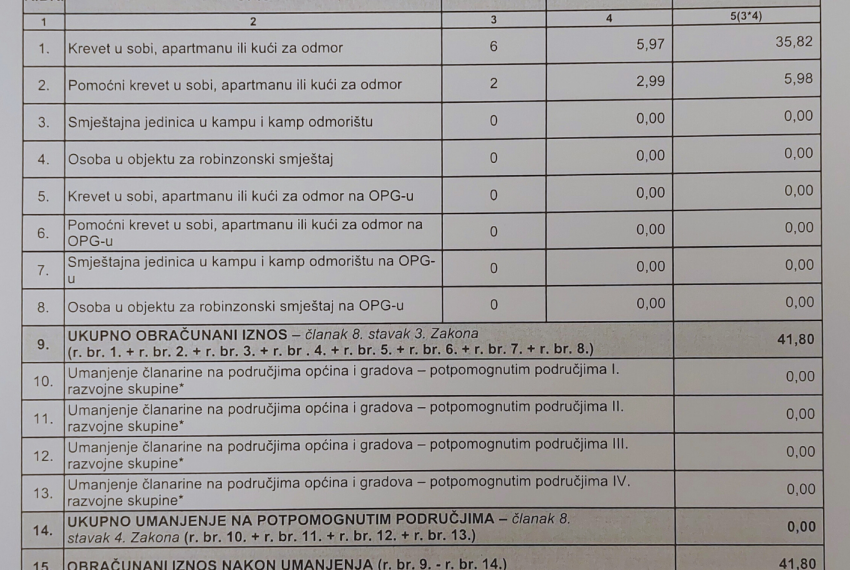

Entering Accommodation Data

The next steps involve entering details about your accommodation:

-

Number of Primary Beds: Enter the exact number of primary beds.

-

Number of Extra Beds: Enter the exact number of extra beds.

-

Unit Price per Bed: Specify the price for both primary and extra beds.

-

Total Price: The system will automatically calculate the total price based on the entered data.

You can also add a reference example of a completed TZ2 form for easier understanding.

Verifying and Submitting the Form

Once you have filled out all the necessary data, follow these steps:

- Click the "Check" button in the upper-left corner.

- If there is an error, the system will notify you and highlight what needs to be corrected.

- If no errors are found, the system will display a message confirming that everything is correct.

- When you're sure all the data is accurate, click the "Submit" button.

Additional Tips

- Always double-check the entered data before submitting to avoid unnecessary mistakes.

- Save the confirmation of your TZ2 form submission for your records.

By following these simple steps, the process of submitting the TZ2 form becomes quick and efficient. If you have any additional questions, contact your tax advisor or reach out to e-Tax system support.

Additional Information According to the Tax Administration Guidelines

According to the Tax Administration's guidelines on the calculation and payment of the tourist membership fee for 2025, please note the following:

Individuals providing catering services in a household must submit the completed TZ2 form to the relevant Tax Administration office between January 1st and 15th, 2025, for the period from January 1st, 2025, to December 31st, 2025. This is in accordance with Article 11 of the Law on Membership Fees in Tourist Communities (NN 52/19 and 144/20), which stipulates that the annual lump-sum membership fee is calculated as the product of the maximum number of beds in a room, apartment, or holiday house from the previous year (as determined by the approval for providing catering services in a household) and the defined fee for each bed (5.97 EUR for a primary bed or 2.99 EUR for an extra bed).

Under item 17 of the TZ2 form, you should enter the total income from the previous year's (2024) business records.

Please note that the form is filled out based on the place of residence or usual residence of the holder of the approval for providing catering services in a household and the corresponding Tax Administration office. The form is submitted via the Tax Administration's unified portal (e-Tax).

The annual lump-sum membership fee, according to the law, can be paid in full by July 31st of the current year or in three equal installments, with the first installment due by July 31st, the second by August 31st, and the third by September 30th of the current year.